Views expressed on this podcast are our own and do not reflect any entity. We may use affiliate links and receive commission, and any advertisements or sponsorships will be clearly stated.

Our content is not professional advice - always consult with a professional. All podcast content is owned by, unauthorized use is prohibited. Information shared is accurate to the best of our knowledge at the time of recording; we are not responsible for any errors or future inaccuracies.

News

SafeMoon Founders Arrested as DOJ Unseals Indictment, SEC Files Charges

Solana NFT App Backpack Launching Crypto Exchange With Dubai License

XRP Ledger Smashes Big Milestone

Google Brain founder Andrew Ng says threat of AI causing human extinction is overblown

ATP Tennis Tour Offers Customizable 2023 Finals Posters via NFT Drop

A ChatGPT Update Could Wreck a Bunch of AI Startups

FTX and the Case for Web3 YIMBYism

3 Greenshoot Sectors in the Blockchain Space

Stellar Co-Founder’s Nonprofit Fires Up 24,000 GPUs for AI Development

Saudi’s NEOM partners with Animoca Brands for regional Web3 development

AI chatbots are illegally ripping off copyrighted news, says media group

3 things we might see from crypto as 2023 winds to an end

Galxe Joins Growing List of Crypto Startups Pivoting to AI

Google Doubles Down with $2 Billion Investment in Claude AI Developer Anthropic

PayPal Secures Crypto Registration in the UK

Modulus raises $6.3 million to bring crypto security to AI

AI Safety Summit: China, US and EU agree to work together

A Forgotten Bust Found Propping Up a Storage Shed Could Net $3 Million for a Tiny Scottish Town

How Paris’s Once-in-a-Lifetime Mark Rothko Exhibition Changes the Way We See His Revered Paintings

November 1, 2023

Embrace Progress, Cultivate Inner Strength, and Share Inspiration

"I embrace progress, cultivate inner strength, and share inspiration."

Numerology - 3 (Creativity, Expression, Communication)

On this November 1, 2023, let us adopt an alpha mindset that encourages us to embrace progress, cultivate inner strength, and share inspiration. Embrace the journey of personal and professional progress, taking steps toward your goals. Cultivate inner strength by tapping into your resilience and determination. Share inspiration and wisdom with those around you, igniting their own journeys of growth and self-discovery.

The numerology of 3 signifies creativity, expression, and communication. Utilize this energy to express yourself authentically and connect with others through kind words and actions.

With this alpha mindset, mantra, and the influence of numerology, may we approach November 1, 2023, with a sense of purpose, inner strength, and a commitment to inspiring others, making it a day of progress, personal growth, and meaningful interactions with others.

The Paradox of Learning

Core Theme: Understanding that the deepest learning occurs through experience and that everyone holds an intrinsic wisdom that doesn't always need conventional teaching to be uncovered.

Key Principles:

Teaching vs. Experiencing: The most significant lessons are often learned through doing and experiencing rather than direct instruction.

Internal Wisdom: There is a well of wisdom within each creator that guides creativity, which can be accessed through introspection and reflection.

Dynamic Roles: The roles of teacher and student are interdependent; one cannot exist without the other. Creators must embrace both roles in their creative pursuits.

Non-Attachment: Embrace the freedom of creating without clinging to knowledge or outcomes, allowing for a more fluid and authentic creative process.

Activities Overview:

Reflect on personal experiences where learning came through action rather than teaching.

Engage in a meditation to tap into inner creativity, followed by a spontaneous creative exercise.

Explore the teacher-student dynamic with role-playing to understand the reciprocal nature of learning and teaching.

Contemplate and discuss how to be both a student and teacher in the creative realm.

Creators should be open to learning continuously and willing to share their insights without reservation. The sharing of knowledge is a form of teaching that enriches both the giver and the receiver.

Action Items:

Practically engage with a new skill or idea and also find an opportunity to teach something to someone else within the week.

By encapsulating these points, you can take away a condensed version of the lesson that captures the essence of learning as a paradoxical, yet deeply interconnected and personal journey.

Budgeting and You

In the realm of personal finance, mastering the art of budgeting is akin to learning a vital life skill. Advanced personal budgeting extends beyond mere expenditure tracking; it is an essential practice that caters to financial well-being and the realization of future aspirations. The progression from basic budgeting principles to more sophisticated financial planning can be likened to a journey that transforms mundane number-crunching into a strategic alignment of one’s finances with their life goals.

Zero-based budgeting

At the heart of advanced budgeting lies the meticulous art of zero-based budgeting. This approach demands that each dollar be assigned a specific role, ensuring a purposeful allocation of income that aligns with one’s financial objectives. Coupled with this is the time-honored envelope system, where money is distributed into physical or digital envelopes, each labeled for a distinct spending category. This tactile financial mechanism promotes disciplined spending and savings.

50/30/20

An intuitive method that has gained popularity for its simplicity and effectiveness is the 50/30/20 rule, which proposes a division of income into three critical segments: necessities, desires, and savings or investments. This rule simplifies financial decision-making by providing a clear framework for prioritizing expenses and savings.

Addressing the complexity of irregular income, advanced budgeting also offers strategies tailored for those with fluctuating earnings. Whether it's freelancers, commission-based workers, or entrepreneurs, these methods provide stability in the face of income variability.

Advanced budgeting encompasses the establishment and prioritization of financial goals. From creating an emergency fund and saving for a home, to planning for retirement, setting objectives is a deliberate process that benefits from the SMART criterion, grounding aspirations in specific, measurable, achievable, relevant, and time-bound parameters.

Turning to the realm of wealth accumulation, savvy individuals employ a range of investment and savings strategies. An understanding of the basics of investing—be it in stocks, bonds, mutual funds, or real estate—is imperative. Leveraging tax-advantaged retirement accounts like IRAs and 401(k)s can significantly enhance one’s financial trajectory, capitalizing on strategies like compound interest and dividend reinvestment to foster wealth growth.

Navigating through debt can often be an intimidating aspect of financial management. Advanced debt management techniques such as the debt snowball or debt avalanche methods provide systematic frameworks for debt reduction, tailored to align with one's psychological preferences and financial circumstances. High-interest debts, particularly from credit cards and payday loans, are given paramount attention, and understanding the nuances of credit scores becomes critical in improving one's financial leverage.

Insurance and risk management play a crucial role in safeguarding one’s financial future. The importance of securing health, life, disability, home, and auto insurance cannot be overstated. These safety nets are complemented by estate planning, including the creation of wills to ensure the distribution of assets according to one’s wishes.

Advanced budgeting also demands tax savviness; maximizing deductions and credits, and employing tax-efficient investment strategies to minimize liabilities and enhance returns. It requires an adept understanding of the tax implications that accompany different investment decisions.

The psychological dimension of financial planning is explored through behavioral finance. It acknowledges that biases and emotions can significantly impact financial choices and teaches individuals how to recognize and overcome these psychological barriers.

In today's digital age, financial technology and tools play a pivotal role in personal budgeting. From budgeting apps like Mint, YNAB, and EveryDollar, which streamline the management of personal finances, to investment platforms like Robinhood, Betterment, and Vanguard, these technologies make sophisticated financial management accessible to the average person.

Lastly, scenario planning is an integral part of advanced budgeting. By building and maintaining an emergency fund, individuals are prepared for unforeseen financial crises. Planning for major life changes, such as marriage, the arrival of children, career shifts, or health challenges, underscores the dynamic nature of financial planning—it is an evolving process that adapts to the ever-changing tapestry of life.

Advanced personal budgeting is not merely a tactic for fiscal discipline but a comprehensive strategy that enriches one's financial literacy, empowers proactive financial decisions, and ultimately paves the way for financial independence and security.

Budgeting and Expense Tracking:

Mint:

Description: A widely-used app that links to your bank accounts and credit cards to automatically track income, expenses, and categorize them.

Key Features: Budget creation, credit score monitoring, bill reminders, and more.

YNAB (You Need A Budget):

Description: A zero-based budgeting tool designed to give every dollar a job.

Key Features: Real-time access to data, goal tracking, debt planning.

EveryDollar:

Description: A budgeting tool from Dave Ramsey that emphasizes zero-based budgeting.

Key Features: Drag-and-drop expenses, split transactions, track spending.

PocketGuard:

Description: Links to your financial accounts and helps you track how much you're earning, spending, and saving.

Key Features: "In My Pocket" feature shows available spending money, insights into recurring bills, and finding better deals.

GoodBudget:

Description: A modern envelope budgeting app for the digital age.

Key Features: Sync and share budgets, debt tracking, and more.

Savings and Investments

Acorns:

Description: Invests your spare change by rounding up your purchases to the nearest dollar and investing the difference.

Key Features: Automated investing, retirement accounts, educational content.

Robinhood:

Description: Commission-free stock, options, and cryptocurrency trading platform.

Key Features: Instant trades, extended trading hours, dividend reinvestment.

Betterment:

Description: A robo-advisor that offers automated investing based on your goals and risk tolerance.

Key Features: Tax-efficient investing, automatic rebalancing, financial planning tools.

Wealthfront:

Description: Another robo-advisor that provides a diversified portfolio based on your risk appetite.

Key Features: Daily tax-loss harvesting, financial planning, and educational content.

Debt and Credit Monitoring

Credit Karma:

Description: Offers free credit scores and reports, along with credit monitoring.

Key Features: Personalized recommendations, credit score simulator, tax filing.

Undebt.it:

Description: A debt snowball/avalanche tool to manage and pay off your debts effectively.

Key Features: Multiple repayment methods, payment tracking, progress reports.

General Finance

Personal Capital:

Description: Combines budgeting tools with wealth management.

Key Features: Investment checkup, retirement planner, fee analyzer.

Spreadsheets

Google Sheets or Excel:

Description: While not a dedicated financial app, many individuals create and customize their budgeting templates. There are also many pre-made 50/30/20 templates available online for these platforms.

When choosing a tool, it's essential to consider factors such as ease of use, security features, integration capabilities, and any associated fees. It's also worthwhile to read user reviews and possibly test a few tools to find one that fits your needs best.

As always please do your own research and consult with who you would need to make your own best decisions.

Personal Well-being

Self-Care Routine: Ensure you have a self-care routine in place to manage stress.

Health Check: Schedule any necessary health appointments before the holiday rush.

Exercise: Maintain or start an exercise routine to boost your energy levels.

Content Planning

Content Calendar: Update your content calendar for November and December.

Holiday Themes: Plan and start creating holiday-themed content.

Year-End Content: Brainstorm ideas for year-end roundups or reflections.

Creation and Production

Creation Goals: Set realistic creation goals for the month.

Production Schedule: Plan your production schedule, considering any holiday disruptions.

Backup Plans: Have a contingency plan for potential delays or issues.

Engagement and Marketing

Engagement Strategy: Plan how to engage with your audience over the holidays.

Promotional Activities: Organize any promotional activities or sales.

Collaborations: Reach out to potential collaborators for holiday-themed projects.

Financial Management

Budget Review: Review your budget and plan for any year-end expenses.

Tax Preparation: Start organizing your financials for tax season.

Income Goals: Evaluate if you are on track to meet your income goals and adjust if necessary.

Learning and Development

Skill Enhancement: Identify any skills you want to improve and find resources or courses.

Industry Trends: Stay updated on the latest trends in your field.

Networking: Look for online or in-person networking opportunities.

Technical Updates

Equipment Check: Ensure all your equipment is in working order.

Software Updates: Perform any needed software updates and backups.

Legal and Administrative

Copyrights and Licensing: Check if you need to renew any licenses or copyrights.

Contracts and Agreements: Review any contracts or agreements that might need attention before year-end.

Website and Online Presence

Website Update: Update your website with any new content, offerings, or portfolio pieces.

SEO Review: Perform a quick SEO review to optimize your online content.

Social Media Profiles: Refresh your social media profiles with current information.

Rest and Relaxation

Downtime: Schedule some downtime to recharge before the holiday season.

Hobby Time: Ensure you have time for hobbies or interests outside of work.

Socialize: Make time to socialize with friends and family, especially if you’ve been particularly busy.

Holiday Preparations

Gift Planning: If you plan on sending out gifts, start your planning and purchasing early.

Travel Arrangements: If you’re traveling, make sure your arrangements are in place.

Reflection

Monthly Review: At the end of the month, review what worked well and what didn’t.

Gratitude: Practice gratitude by reflecting on what you’ve accomplished and who helped you along the way.

Remember to stay flexible with your plans, as unexpected events can sometimes throw a wrench in the works. It's also important not to overburden yourself; balance is key to maintaining creativity and productivity.

Spotlight of the Day

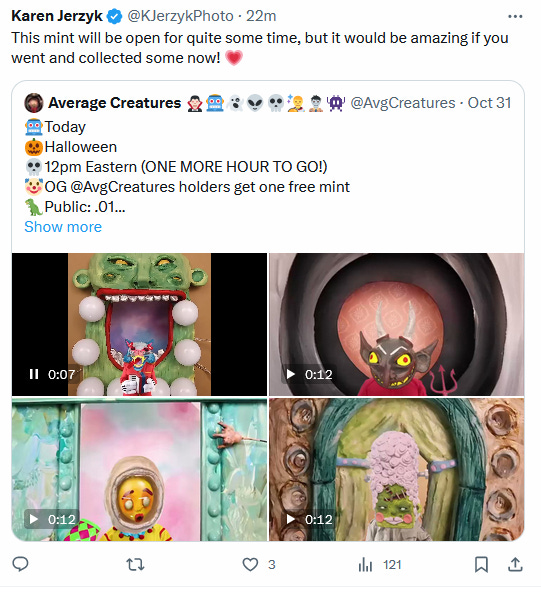

Karen Jerzyk @KJerzykPhoto

Amazing OG artist in the space.

A fully established with a signature style that we have loved for a while.

Dedicated artist in the space that does not disappoint when it comes to Twitter Spaces and debate.

Multiple sold lines and has one currently available.

We are honored to call Karen a friend. We are a fan and we suggest notifications on for and a definite follow.

We are so happy to give this Spotlight of the day to Karen.

Checkout Art section for her current drop (project)

Share this post